I have used it with several retailers without issue, most frequently with ASOS, Macy’s and DSW, and I can tell yoou that the shipping of my items remained the same as it would if I had used a credit card. Klarna started me off with a limit of $600 and began increasing it gradually once I showed financial responsibility through on-time and sometimes early payments. The initial approval process took mere minutes, allowing me to sign up quickly without any hard inquiries to my credit profile. Before joining Spy as an E-Commerce Editor, I personally used Klarna (and other Buy Now, Pay Later services) at several retailers without issue. Spy’s Review: We Tested Klarna, And We’d Use It Againīelow, I’ll answer some common questions about Klarna.

#Klarna slice it review series

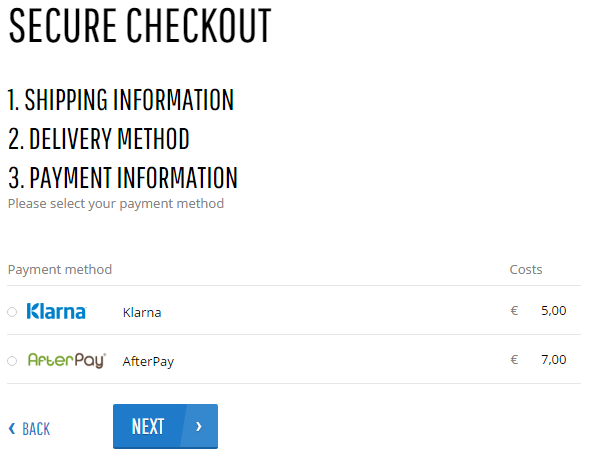

Klarna customers can have the shoes delivered immediately but pay for the shoes with a series of smaller payments over a period of several months. Or, you can use our app and enjoy flexible payment options anywhere online.” For example, let’s say you have your eyes on a pair of designer sneakers that cost $750. Klarna’s website explains, “We partner with retailers all over the world to make it easy to pay how you like right from checkout. It specifically assists in making point-of-sale purchases by offering no-interest loans that allow consumers to buy now and pay later at thousands of stores around the world. And who isn’t on a tight budget these days? Although there are many financial tech companies offering buy now, pay later programs, we’ve decided to take a closer look at one in particular in today’s review: Klarna.īased in Sweden, Klarna provides payment solutions that make purchasing simple and safe for buyers and sellers. Payment platforms like Klarna break down your total purchase price into smaller and more digestible payments - a structure that can appeal to younger, savvy shoppers on a budget. (Except way better, because you get your items immediately.)

0 kommentar(er)

0 kommentar(er)